SmarDex Tokenomics: Understanding SDEX Mechanisms

2024-08-19

Bittime - SmarDex stands out in the DeFi landscape with its innovative approach to incentivizing liquidity providers and building a sustainable ecosystem.

This article discusses the core aspects of SmarDex tokenomics, the SDEX token itself, and the mechanisms that drive its value.

Get to Know SmarDex

SmarDex is a decentralized finance (DeFi) platform that aims to improve the functionality of decentralized exchanges (DEX). This is a type of Automated Market Maker (AMM) designed to provide a smoother and safer trading experience.

What is SDEX Token?

SDEX is the lifeblood of the SmarDex protocol. This has a dual purpose: rewarding users for their participation and driving platform growth. Users can earn SDEX through various activities, including:

- Staking: Lock their SDEX tokens and earn passive income from trading fees.

- Farming: Participate in liquidity pools and earn rewards based on their contributions.

- Community Rewards: Get involved in the SmarDex ecosystem and receive SDEX as a token of appreciation.

SDEX Fixed Supply Advantages

SmarDex offers a fixed total supply of 10 billion SDEX tokens, ensuring predictable distribution and potentially increasing the value of each remaining token over time. This model is in stark contrast to the inflationary token structure commonly found in DeFi.

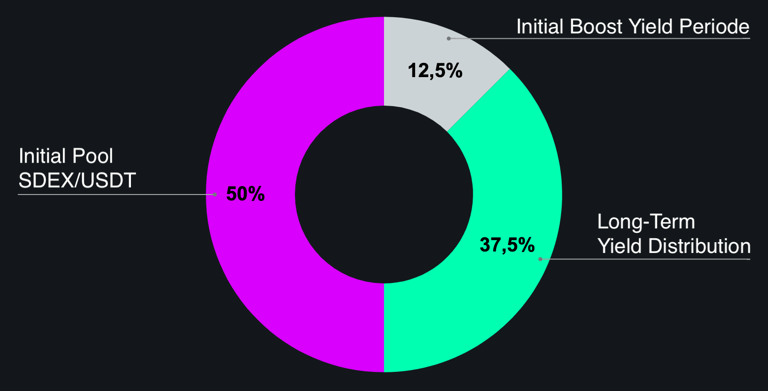

SDEX Initial Distribution Details

The initial distribution of SDEX tokens highlights the platform's commitment to long-term sustainability and user rewards. Here are the details:

- Volatility Vault (50%): This vault uses a portion of SDEX tokens to create a buffer against price fluctuations, reducing temporary losses for liquidity providers.

- Long Term Yield Distribution (37.5%): This share is allocated over ten years to reward liquidity providers, stakers, and users who contribute to the growth of the ecosystem through community initiatives.

- Increased Yield Period (12.5%): This initial incentive program offered a large amount of SDEX tokens to early adopters providing liquidity during the platform launch phase.

Sustainable SDEX Distribution

Currently, the only way to “mine” SDEX tokens is through long-term yield distribution. This distribution schedule gradually releases SDEX tokens over ten years, with a decreasing percentage allocated each year.

This approach ensures a continuous flow of rewards for users while maintaining a controlled supply.

Multipliers: Balancing Distribution

SmarDex uses a Multipliers system to distribute SDEX tokens between farming campaigns, staking rewards and community incentives.

These multipliers determine the relative share of SDEX allocated to each activity, allowing for flexible adjustments based on market conditions and platform needs. This ensures rewards are directed where they can create the most value for the ecosystem.

Dynamic Fees and Buybacks

SmarDex uses a dynamic fee structure on each Volatility Vault, meaning fees adjust based on the volatility of the token pair.

These fees are then used to buy back SDEX tokens, which are redistributed to liquidity providers and stakers or burned (depending on the chain). This buyback mechanism helps maintain the value of SDEX tokens and encourages continued participation in the platform.

Deflation Step: Combustion Mechanism

For transactions on certain chains (Polygon, Arbitrum, BSC, Base), a portion of the collected fees is used to buy back and burn SDEX tokens. This process effectively removes SDEX from circulation, creating a deflationary effect on the token's overall supply.

Transparency and Automation

SmarDex leverages smart contracts to automate the buyback and burning of SDEX tokens, ensuring efficiency, transparency and eliminating the possibility of human manipulation.

Conclusion

SmarDex tokenomics is carefully designed to create a win-win situation for all stakeholders.

By offering fixed supply, diverse reward mechanisms, dynamic fee structures, and deflationary measures, SmarDex builds a sustainable and rewarding environment for liquidity providers, stakers, and the DeFi community as a whole.

As the platform continues to develop, its innovative tokenomics will play a critical role in its long-term success.

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Learn How to Buy Crypto on Bittime.

Monitor price chart movements of Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.