Tokenomic of Harmony (ONE)

2024-07-20

Bittime - After a thorough evaluation, Harmony has updated the Harmony network's economic framework in preparation for the upcoming open staking launch. The updated model ensures that the total network reward - consisting of issuance and transaction fees - remains stable regardless of the average block time and staking ratio.

This revision aims to increase the staking ratio, simplify the economic model, and pave the way for zero issuance, which the Harmony team expects will yield long-term benefits for Harmony.

The Importance of Higher Staking Ratios

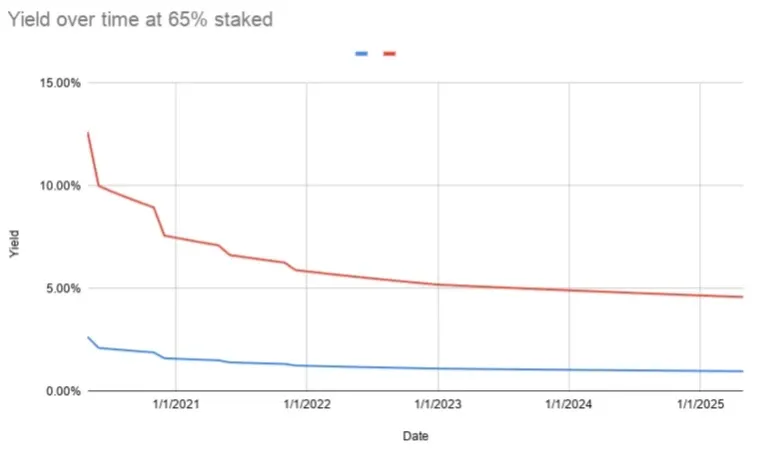

A higher staking ratio offers a dual benefit. First, it serves as a health indicator for the Proof-of-Stake (PoS) chain. A high staking ratio (above 60%) indicates strong network security, since a 33% attack requires control of at least 20% of the token supply.

Additionally, a high staking percentage reflects a committed and loyal community that is invested in the project’s survival. When more than 60% of tokens are staked, it indicates that the majority of tokens are held by dedicated HODLers.

Second, higher staking ratios drive organic demand for ONE tokens. While long-term demand for ONE will be driven by on-chain application adoption, the most significant driver of immediate demand is staking. Harmony believes that increased staking yields will increase the appeal of ONE staking, driving demand.

Also Read How To Buy Crypto:

The Power of Simplicity

Bitcoin exemplifies the effectiveness of simplicity with its easy-to-understand economic model: “Issuance halves every 4 years to a maximum supply of 21 million.” This straightforward approach facilitates community understanding and acceptance. In contrast, complex economic models hinder widespread adoption.

Inspired by the Bitcoin model, the Harmony team designed Harmony's economic framework to be similarly concise: "Issuance plus transaction fees is set to 441 million ONE per year."

This simplicity allows validators to easily project their future rewards and token holders to forecast future circulating supply, building a stable economic foundation for stakeholders.

Transaction Fees as a Sustainability Mechanism

One potential vulnerability of Bitcoin lies in its reliance on transaction fees to compensate for the decline in block reward issuance. To ensure long-term viability, any protocol must generate enough transaction fees to cover the costs of operating and securing the network. However, predicting when transaction fees will be sufficient is challenging.

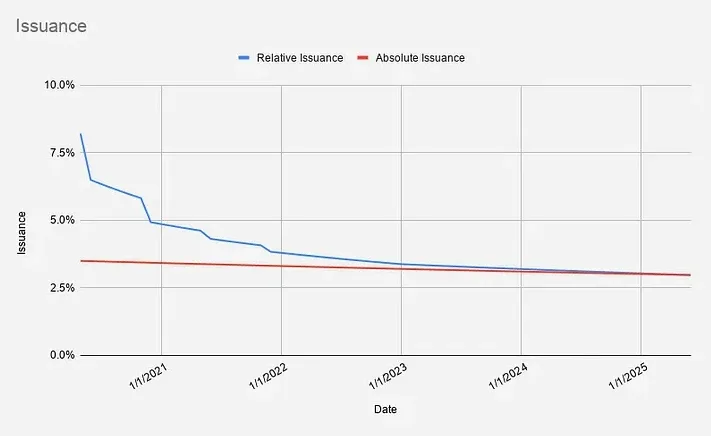

The Harmony model addresses this problem by allowing transaction fees to gradually replace issuance. As network usage grows, issuance decreases accordingly. Once the network can sustain itself purely on transaction fees, issuance drops to zero.

This adaptive approach ensures a stable funding source for network security while maintaining a potentially limited supply of ONE tokens, similar to Bitcoin.

Check Crypto Market Today:

Key Differences from Previous Models

The new model differs from the old model by maintaining a constant annual issuance of 441 million ONE, unlike the previous variable issuance model. Previously, issuance decreased from ~500 million at 0% staking to 0 ONE at or above 80% staking.

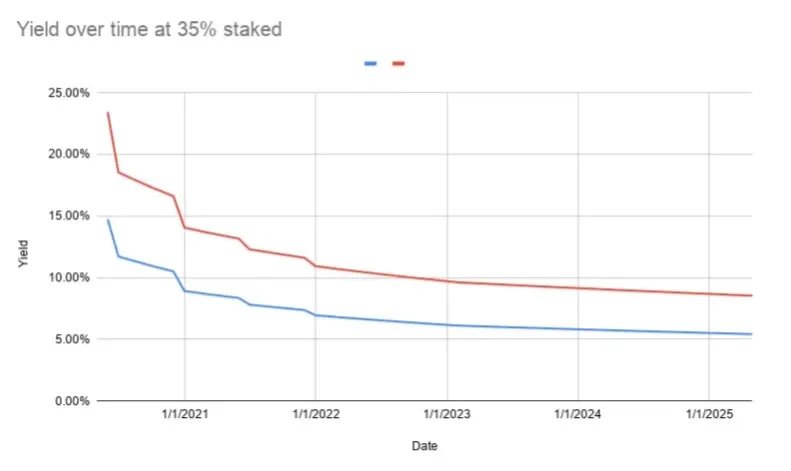

The revised model offers slightly smaller rewards at staking ratios below 10% but much higher rewards above this threshold.

In the first year, returns ranged from 164% (at 5% staking) to 9% (at 95% staking), and in the third year, from 73% (at 5% staking) to 4% (at 95% staking).

This generous reward structure should attract stakers and validators, as it promises larger rewards compared to the legacy model.

Reasons Behind the Change

Harmony’s model shift is driven by evolving assumptions and insights. Initially, Harmony aimed for minimal issuance to reduce inflation while maintaining safety.

However, Harmony recognizes that cultivating a strong validator and staker community early on outweighs the potential downside of inflation. By leveraging transaction fees to offset issuance, Harmony can effectively limit long-term inflation.

Another assumption is that staking competes with use cases that require collateral, such as DeFi.

The emergence of “staking derivatives” reduces this competition, allowing derivatives of staking tokens to serve as collateral.

Finally, the constant issuance per block of the old model will increase with shorter block times, leading to higher overall issuance.

How to Buy Crypto with Bittime

You can buy and sell crypto assets easily and safely through Bittime. Bittime is one of the best crypto applications in Indonesia that has been officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed your identity verification. Also, make sure you have sufficient balance by depositing some funds into your wallet. Just so you know, the minimum asset purchase on Bittime is IDR 10,000. After that, you can make crypto asset purchases in the application.

Monitor the price chart movements of Bitcoin (BTC) , Ethereum (ETH) , Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.