Long-Term Price Prediction of The Grays Currency (TGC) 2025–2030

2025-12-08

If you've been following the Pulse Chain ecosystem, The Grays Currency (TGC), or PTGC, is likely familiar. This token has become a hot topic due to its unique mechanism, decentralized DAO, lock-up-free staking, and LP buyback system that makes its supply increasingly scarce over time.

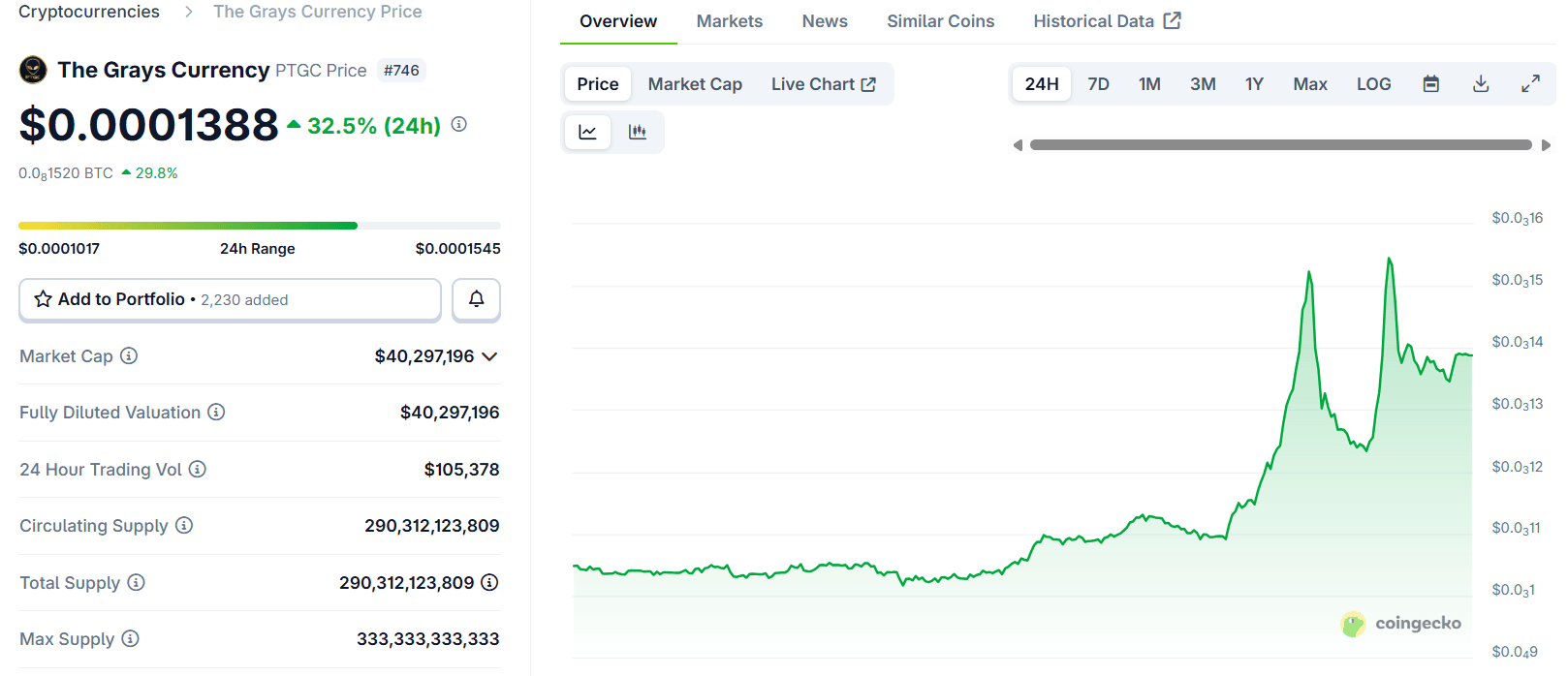

With a current price of around $0.00074 USD, a market cap of $216 million, and a circulating supply of 291 billion tokens, investors are starting to wonder: how far can TGC rise in the next five to six years? Let's dissect the long-term predictions.

PTGC Price Projection 2025–2026

TGC's short and medium term predictions are heavily influenced bydinamika Pulse Chainand PulseX as the main platform where these tokens are traded.

Currently, technical analysis shows bullish sentiment with support from RSI and SMA pointing to short-term upside opportunities.

2025 Prediction

According to the average projection model, the price of TGC in 2025 is estimated to be in the range of:

- $0.000722 – $0.001612

Compared to the current price, this range suggests a potential upside of up to 108%. This is quite realistic, considering that Pulse Chain-based projects are starting to gain traction in the alternative blockchain community amidst the crowds from Ethereum and BSC. Price increases in 2025 could also be driven by:

- The growth of the Pulse Chain investor community

- Maturating DAO activities

- Increasingly attractive staking incentives without the risk of lock-up

2026 Prediction

In 2026, the price projections become wider, namely:

- $0.000436 – $0.002315

Why is the range so much more extreme? Because in 2026, both bullish and bearish scenarios are equally likely, depending on two major factors:

- TGC DAO adoption — are more holders participating in voting and staking?

- PulseX growth — as the main DEX of the Pulse Chain ecosystem, transaction volume greatly impacts TGC liquidity.

If PulseX successfully attracts significant liquidity, TGC could approach its highest level. However, if the Pulse Chain ecosystem stagnates, the price could still return to low levels.

Read Also:SpaceN (SN) Token Long Term Price Prediction

TGC Price Projection 2027–2030

The further out the prediction, the more speculative the results. However, we can still highlight trend data andvisible growth indicatorstoday.

2027–2028 Predictions

At this stage, TGC is expected to enter a mid-growth phase, where investors begin to assess whether its deflationary mechanism is truly effective. If buyback activity remains stable, TGC's supply could gradually decrease, increasing the token's value.

However, volatility remains high because:

- Dependence on the Pulse ecosystem

- Global regulatory risks to DAOs

- Adoption rates can fluctuate

2029 Prediction

In 2029, the analytical model estimates the price of TGC to be in the range of:

- $0.001114 – $0.003516

If a bullish scenario occurs, this level indicates a potential increase of up to 355% from the baseline price. Possible catalysts that could drive the price:

- PulseX's trading volume, which now reaches $744,000 per day, has the potential to continue growing.

- TGC often outperforms other meme tokens (+24% in the last week)

- The deflationary mechanism becomes more pronounced as the DAO grows.

2030 Predictions

2030 marks the most optimistic long-term projection. The average forecast model places TGC prices at:

- $0.000903

This figure may seem small, but it still represents growth of around 28% from the baseline, a stable scenario that is considered moderate in the volatile crypto market.

Read Also:Monad Long Term Price Prediction

Risk Factors Investors Must Understand

While TGC appears promising, it remains a high-risk asset, especially for investors interested in meme tokens or experimental projects. Here are the risks you should be aware of:

1. Limited Liquidity

TGC's trading volume is not as large as other major tokens, so price volatility can be more extreme.

2. Dependence on Pulse Chain

If Pulse Chain fails to scale or faces technical/regulatory challenges, the impact will be felt directly on TGC.

3. Crypto Regulation

DAOs and deflationary tokens are on the regulatory radar of many countries. This uncertainty could depress demand.

4. High Speculation

Most of TGC's price movements are driven by community sentiment, not concrete utility.

Read Also:Openverse Network BTG Price Prediction

Come on, register for Bittime first

Before you consider purchasing or looking further into TGC, make sure youalready registered on the Bittime platformThis exchange is known for being beginner-friendly, secure, and supporting popular crypto assets frequently discussed by the community.

Conclusion

The Grays Currency (TGC) price prediction for 2025–2030 shows exciting growth potential, especially if the Pulse Chain ecosystem continues to develop.

With a projected price potential of between 28% and 355% in the long term, TGC is more suitable for investors who are prepared to face high risks and extreme volatility.

However, all predictions remain speculative. Be sure to conduct your own research, understand the risks, and manage your portfolio wisely.

FAQ

Is The Grays Currency (TGC) a safe long-term investment?

Not completely safe. TGC is a high-risk asset due to its volatility and dependence on the Pulse Chain ecosystem.

Why could TGC prices rise significantly in the next few years?

Factors include deflationary mechanisms, the growth of the DAO community, and the increase in PulseX trading volume.

Are TGC price projections guaranteed to be accurate?

No. All crypto predictions are speculative and subject to change due to market conditions.

Where can I buy TGC?

TGC is currently widely traded on PulseX. To start investing in crypto in general, you can register on Bittime.

Is TGC suitable for beginner investors?

Only if you are ready to take high risks. Beginners are advised to understand the basics of crypto before buying.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.