Bitcoin (BTC) Price Prediction for February 9, 2026

2026-02-08

Bittime – Bitcoin returned to the spotlight on February 8, 2026, after a sharp decline from the prior consolidation zone above USD 88,000.

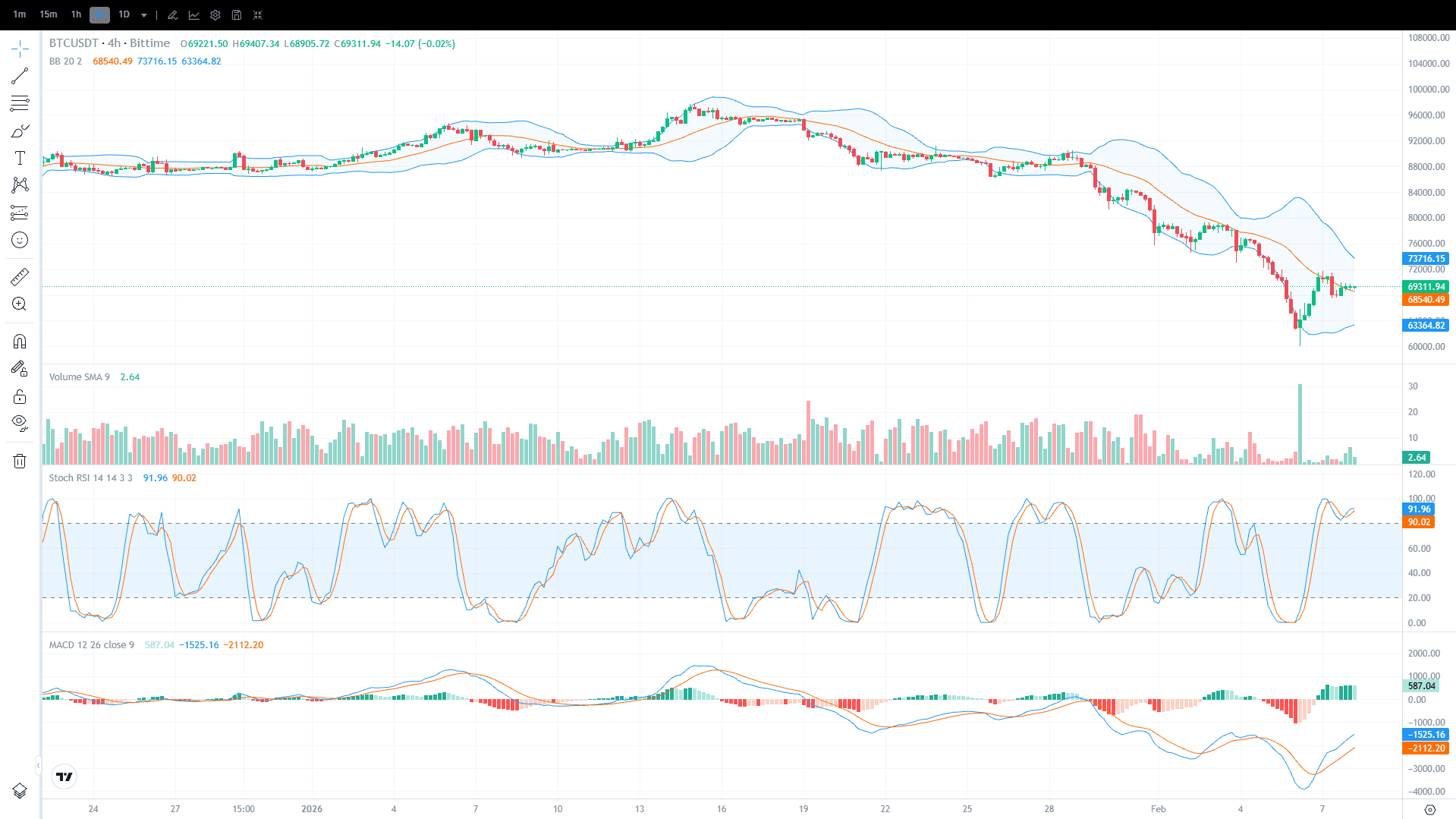

The latest data on the 4-hour chart shows BTC trading around USD 69,311.94 and relatively flat (-0.02%) compared to the previous candle close. After briefly tagging the lower area (wick) around USD 63,000–64,000, BTC rebounded and is now consolidating below the psychological USD 70,000 level. The chance of a relief rally remains open if price can hold above dynamic support and break through the nearest resistance.

Key Takeaways

- Bitcoin is trading around USD 69,311 today, consolidating below USD 70,000 after rebounding from a sharp sell-off.

- Nearest support is at USD 68,500–68,000, while major support sits at USD 64,000–63,000.

- Nearest resistance is at USD 70,000–70,500, with the next resistance zone at USD 73,000–74,000.

Bitcoin Price Today

Bitcoin’s price on February 8, 2026, on the Bittime market (4-hour chart) was recorded at USD 69,311.94. This move reflects a consolidation phase after bouncing from the lower area around USD 63,000–64,000. From a technical perspective, BTC remains below the psychological USD 70,000 level, so recovery confirmation still tends to wait for a breakout above the nearest resistance.

BTC - USDT via Bittime Market

Bitcoin Price Performance on February 8, 2026

Bitcoin performance on February 8 is best read through technical indicators. After the rebound, Stoch RSI is in the upper zone (near overbought), so a brief pause/minor pullback would still be reasonable before any further upside attempt.

In terms of volatility, Bollinger Bands outline dynamic boundaries: the basis is around USD 68,540, while the upper band sits near USD 73,716. This means BTC would need to break above the USD 70,000–70,500 area first to open the way toward the next resistance zone at USD 73,000–74,000.

If price can hold above the USD 68,500–68,000 support zone, a move toward the USD 70,000–70,500 resistance area remains possible. Conversely, a drop below USD 68,000 could drag price back to retest the USD 64,000–63,000 zone.

Latest Market Analysis

Based on the latest technical read of price action, Bitcoin remains in a recovery phase after a sharp drop and is now tending to consolidate below USD 70,000. Selling pressure briefly pushed a wick into the USD 63,000–64,000 area, but buying interest lifted price back into the USD 69,000 range.

However, because oscillators are elevated after the bounce, further confirmation still hinges on holding above the USD 68,500–68,000 support zone and breaking through the USD 70,000–70,500 resistance.

Factors Influencing the BTC Price Forecast

Technical Support and Resistance: Nearest support is at USD 68,500–68,000, with major support at USD 64,000–63,000. Nearest resistance is at USD 70,000–70,500, with the next target zone at USD 73,000–74,000. If BTC holds above USD 68,000 and can break above USD 70,500, the odds of a relief rally increase.

Selling Pressure and Profit-Taking: High volatility after the sharp drop encourages traders to take quick profits on rebounds, leaving price vulnerable to stalling below USD 70,000.

Macroeconomic Factors: Stable U.S. inflation data provides room for risk assets like Bitcoin, but global interest-rate policy remains a key variable.

Institutional Capital Flows: Bitcoin ETFs remain a positive catalyst through institutional inflows, although global uncertainty continues to pose risks.

Social and Community Sentiment: Discussions on social media point to medium-term optimism around institutional adoption, although short-term volatility remains elevated.

Conclusion

Bitcoin’s price on February 8, 2026, is around USD 69,311, signaling a consolidation phase after rebounding from the USD 63,000–64,000 lower area.

The base scenario points to short-term movement within USD 68,000–70,500, with an extension toward USD 73,000–74,000 if resistance is broken. On the other hand, a drop below USD 68,000 opens up the risk of a retest of the USD 64,000–63,000 zone.

Investors are advised to monitor key support and resistance levels and keep an eye on external factors such as interest-rate policy and institutional capital flows.

FAQ

What is the Bitcoin price today, February 8, 2026?

Bitcoin is trading around USD 69,311.94 on the 4-hour chart, relatively flat (-0.02%) compared to the previous candle close.

What is the Bitcoin price prediction for February 8, 2026?

BTC is expected to trade within USD 68,000–70,500, with a potential extension to USD 73,000–74,000 if resistance is successfully broken.

Where is Bitcoin’s current support level?

The nearest support is in the USD 68,500–68,000 area, with major support at USD 64,000–63,000.

Where is the nearest Bitcoin resistance?

The nearest resistance is around USD 70,000–70,500, followed by the next resistance zone at USD 73,000–74,000.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.