Meme Coin USOR Rises After Venezuelan Oil Assets Headlines: Risks & Red Flags

2026-01-22

The surge in meme coin prices is back in the spotlight, this time throughUSOR (U.S. Oil), a Solana-based token that suddenly went viral after headlines emerged regarding the sale of Venezuelan oil assets by the United States.

In a short period of time, USOR recorded a 150% increase and even reached a market capitalization of over USD 40 million. However, was this surge truly supported by fundamentals, or was it merely a dangerous momentary euphoria?

Key Points

- The rise in USOR prices was driven by speculation, not official confirmation or strong fundamentals.

- Price movement patterns and on-chain data indicate a risk of manipulation.

- Claims of links to US oil assets lack legal or institutional backing.

The Phenomenon of the Sharp Increase in USOR

USOR is a meme coinA Solana-based cryptocurrency with the theme "U.S. Oil." This token began attracting attention when several crypto traders and influencers linked it to news of the sale of Venezuelan oil assets seized by the United States.

The narrative developing on social media implies that USOR has an indirect connection to US oil reserves.

Driven by the hype, the price of USOR soared to around USD 0.04, with daily trading volume approaching USD 20 million.

On platforms like CoinGecko and Solana DEXs like Meteora, USOR became a trending token for a very short time, especially around January 20, 2026.

However, it's important to note that there has been no official statement from US authorities, regulators, or energy institutions confirming any link between USOR and real oil assets. This rally is driven purely by market sentiment and wild speculation.

Read Also:How to Buy U.S Oil (USOR): A Complete Guide for Beginners

Main Triggers: Speculation and Social Media Narratives

One of the main triggers for the surge in USOR was a claim on its official website regarding the on-chain tokenization of oil reserves.

This claim sounds attractive, but it is not accompanied by legal documents, proof of asset ownership, or official cooperation with any party.

Social media played a significant role in accelerating the spread of this narrative. Within hours, USOR became a hot topic on Twitter, Telegram, and the Solana Discord community. FOMO (fear of missing out) drove many retail traders to enter at high prices without conducting thorough verification.

This phenomenon is very common in the world of meme coins, where “plausible-sounding” stories often have more impact than factual data.

Read Also:What is USOR Meme Coin?

Key Risks: Extreme Volatility and Unhealthy Patterns

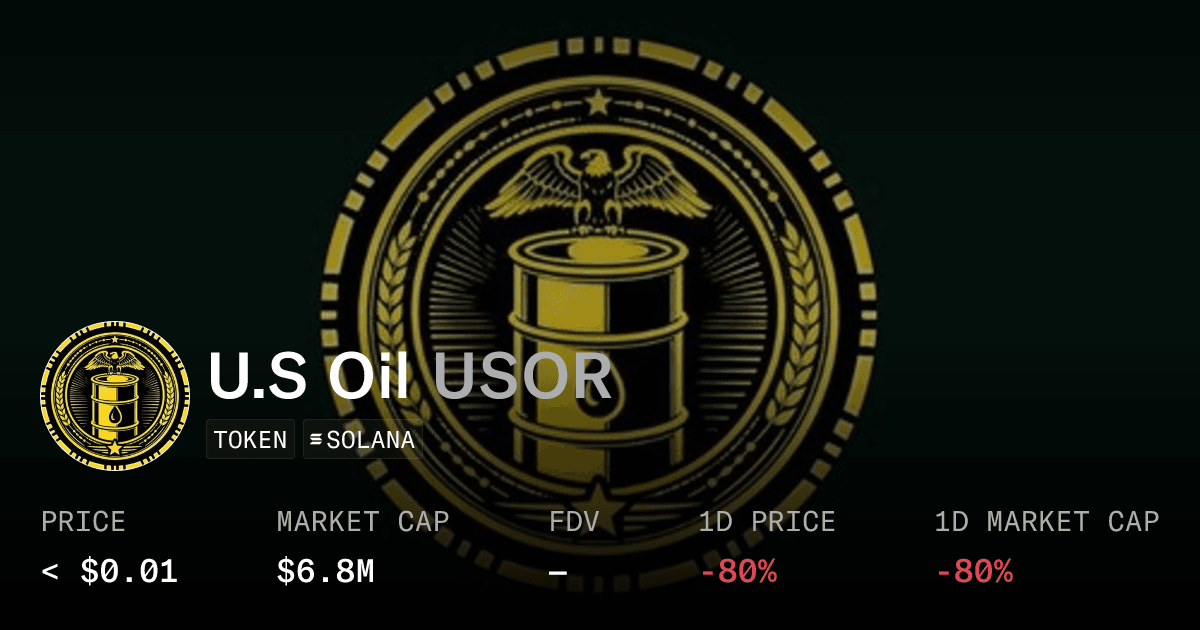

After peaking, the price of USOR plummeted more than 80% to around USD 0.01. This sharp drop served as a stark reminder of the meme coin's extreme volatility.

On-chain data shows a pattern of near-vertical price increases, followed by sharp declines within a short period of time.

This pattern is often associated with pump and dump schemes, where a group of parties enters early, drives the price up, then dumps the asset when liquidity from retail buyers comes in. For investors who enter late, the risk of being trapped at the peak price is significant.

Red Flags That Cannot Be Ignored

There are several important red flags that emerge from the USOR case:

Wallet Concentration

Bubble map analysis shows that several of the largest wallets are interconnected. This indicates possible control by insiders or a small group, who could easily manipulate prices.

Thin Liquidity

USOR is traded exclusively on Solana DEXs like Meteora, without a listing on a major centralized exchange. Thin liquidity increases the risk of slippage and makes it easier for rug pulls to occur.

No Real Backing

Claims of ties to US oil have not been verified by any authorities. Without legal evidence or real assets, the narrative sounds more like an aggressive marketing strategy than a financial innovation.

Read Also:USOR Coin Facts: Claims, Trump Issues, and Things to Watch Out For

Important Lessons for Crypto Investors

The USOR case reiterates the importance of due diligence, especially when dealing with meme coins. Rapid price increases are tempting, but often not worth the risk.

Investors need to distinguish between projects with real utility and tokens that rely solely on viral hype. Understanding on-chain data, ownership structures, and liquidity sources is crucial before making a decision.

Register at Bittime, Safe and Trusted

Before investing in any crypto asset, make sure you use a platform that is legal and registered in Indonesia.

For a safer and more educated trading experience, you can doregistration on the Bittime platformand start exploring the world of crypto assets with more confidence.

Conclusion

The surge in USOR's price demonstrates the powerful influence of narrative and speculation in the crypto market, particularly in the meme coin segment.

Despite its fantastic rise, USOR's rapid decline opened investors' eyes to the latent risks often hidden behind the hype.

Without clear fundamentals, strong liquidity, and transparency, tokens like USOR are better viewed as high-risk speculative instruments, rather than long-term investments.

FAQ

What is USOR meme coin?

USOR is a Solana-based meme coin with a “U.S. Oil” theme that went viral due to market speculation.

Why did the USOR price rise sharply?

The rise was fueled by social media hype linking it to news of Venezuelan oil assets, despite no official evidence.

AIs USOR really backed by US oil assets?

There is no legal evidence or authoritative confirmation to support these claims.

What are the main risks of buying USOR?

Extreme volatility, wallet concentration, thin liquidity, and potential price manipulation.

Is USOR suitable for long-term investment?

USOR is more speculative and high risk, making it less suitable for conservative long-term strategies.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.