Crypto 101: Understanding Trading with Bollinger Bands

2024-06-24

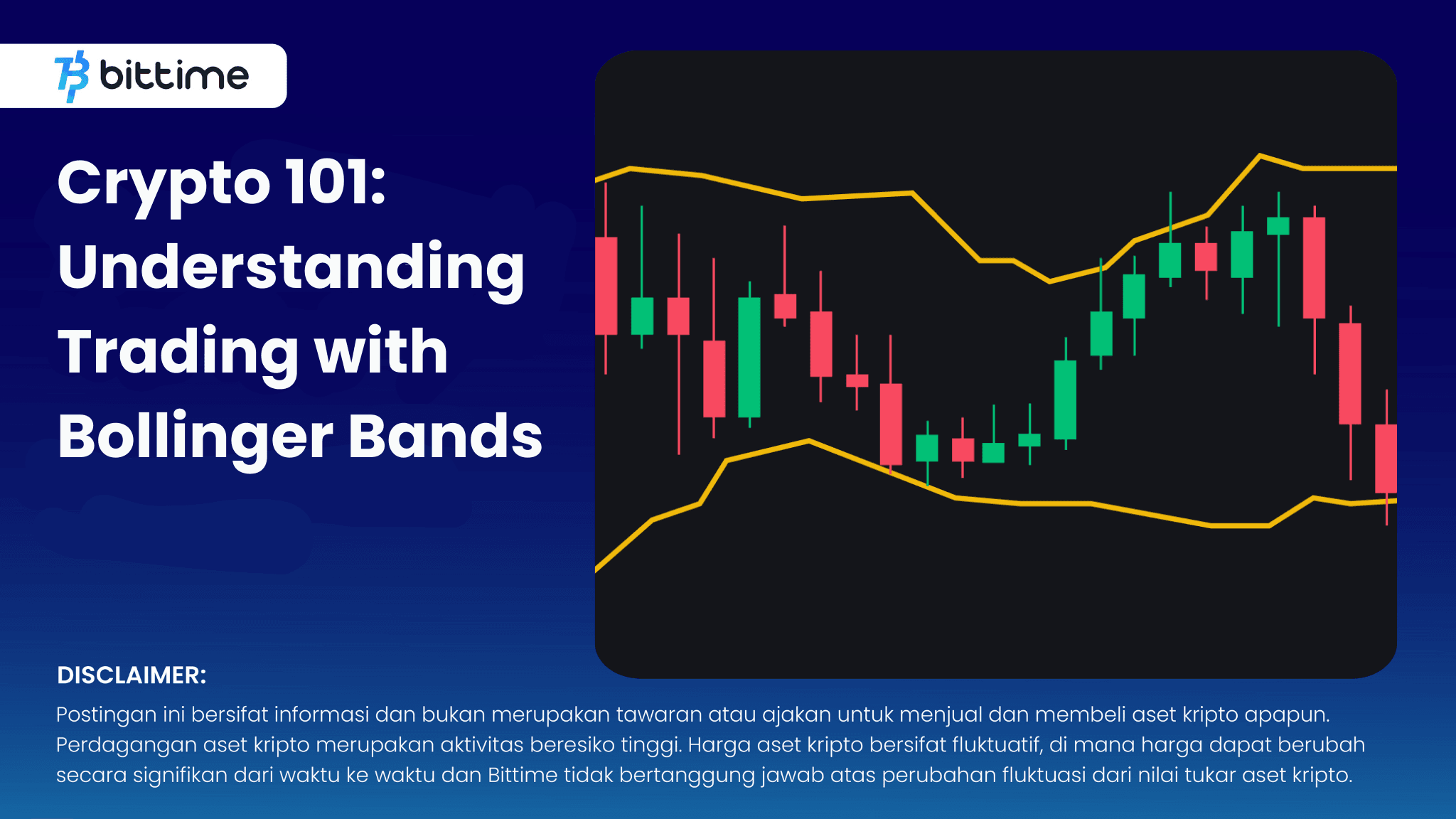

Bittime - Bollinger Bands is a technical analysis indicator created by John Bollinger in the 1980s. This indicator is used to measure market volatility and identify potential price turning points.

Check Today's Crypto Market: PYTH/IDR

Bollinger Bands section

Bollinger Bands consist of three lines, namely:

- Middle Bands: This line is a Simple Moving Average (SMA) with a certain period, usually 20 days.

- Top line (Upper Band): This line is located above the center line at a distance of twice the standard deviation.

- Bottom line (Lower Band): This line is located below the center line at a distance of twice the standard deviation.

Also Read How To Buy Crypto: How to Buy BTC

How to Use Bollinger Bands

There are several ways to use Bollinger Bands in trading:

1. Identify Overbought and Oversold Areas

When the price approaches the Upper Band, the market is considered overbought and has the potential to experience a correction.

Conversely, when the price approaches the Lower Band, the market is considered oversold and has the potential to experience a rebound.

2. Determining Price Reversal Points

Bollinger Bands can help traders to identify price turning points. When the price breaks the Upper Band with strong momentum, this can indicate a new uptrend.

Conversely, when the price breaks the Lower Band with strong momentum, this may indicate a new downtrend.

3. Measuring Market Volatility

The width of Bollinger Bands indicates market volatility. When Bollinger Bands widen, the market becomes more volatile. Conversely, when Bollinger Bands narrow, the market becomes less volatile.

Check Crypto Prices Today: DOGE/IDR price

Strategy Trading Bollinger Bands

There are several popular trading strategies using Bollinger Bands:

- Strategy Bollinger Bounce: This strategy involves buying when the price approaches the Lower Band and selling when the price breaks the Upper Band.

- Strategi Bollinger Squeeze: This strategy involves buying when the Bollinger Bands narrow and selling when the Bollinger Bands widen.

- Strategy Bollinger Breakouts: This strategy involves buying when the price breaks the Upper Band with strong momentum and selling when the price breaks the Lower Band with strong momentum.

Benefits of Using Bollinger Bands

Here are some of the advantages of using Bollinger Bands for trading.

- Bollinger Bands is an indicator that is easy to understand and use.

- Bollinger Bands can help traders to identify overbought and oversold areas.

- Bollinger Bands can help traders determine price turning points.

- Bollinger Bands can help traders to measure market volatility.

Disadvantages of Using Bollinger Bands

There are advantages, of course there are disadvantages. Learn the disadvantages of using Bollinger Bands when trading below.

- Bollinger Bands are not always accurate in predicting future price movements.

- Bollinger Bands can give false signals, especially in ranging markets.

- Bollinger Bands do not take into account other fundamental factors that can influence prices.

Understanding Market Volatility with Bollinger Bands

The width of Bollinger Bands indirectly indicates market volatility. When the distance between the Upper Band and Lower Band widens, this indicates increased volatility.

Conversely, when their gap narrows, market volatility is decreasing. Increased volatility is often associated with strong price trends, either up or down.

Conversely, a narrowing Bollinger Bands could signal a potential breakout or period of price consolidation.

Strategi Bollinger Squeeze

Bollinger Squeeze is a strategy that takes advantage of the narrowing of Bollinger Bands. When Bollinger Bands narrow, it can be an indication that price is consolidating after a large move.

Traders who use the Bollinger Squeeze strategy may delay trading execution until the price moves out of the Bollinger Bands, anticipating a potential breakout upward (Bullish Breakout) or downward (Bearish Breakout).

Combination with Other Indicators

Bollinger Bands are effective when used in conjunction with other technical indicators.

For example, when Bollinger Bands show a potential breakout, traders can use momentum indicators such as RSI or MACD to get confirmation of trading signals.

Conclusion

Bollinger Bands is a technical analysis indicator that is useful for both beginners and experienced traders.

This indicator can help traders to identify overbought and oversold areas, determine price turning points, and measure market volatility.

However, it is important to remember that Bollinger Bands are not always accurate and should be used in conjunction with other indicators and fundamental analysis.

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via over. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets at over, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet.

For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.