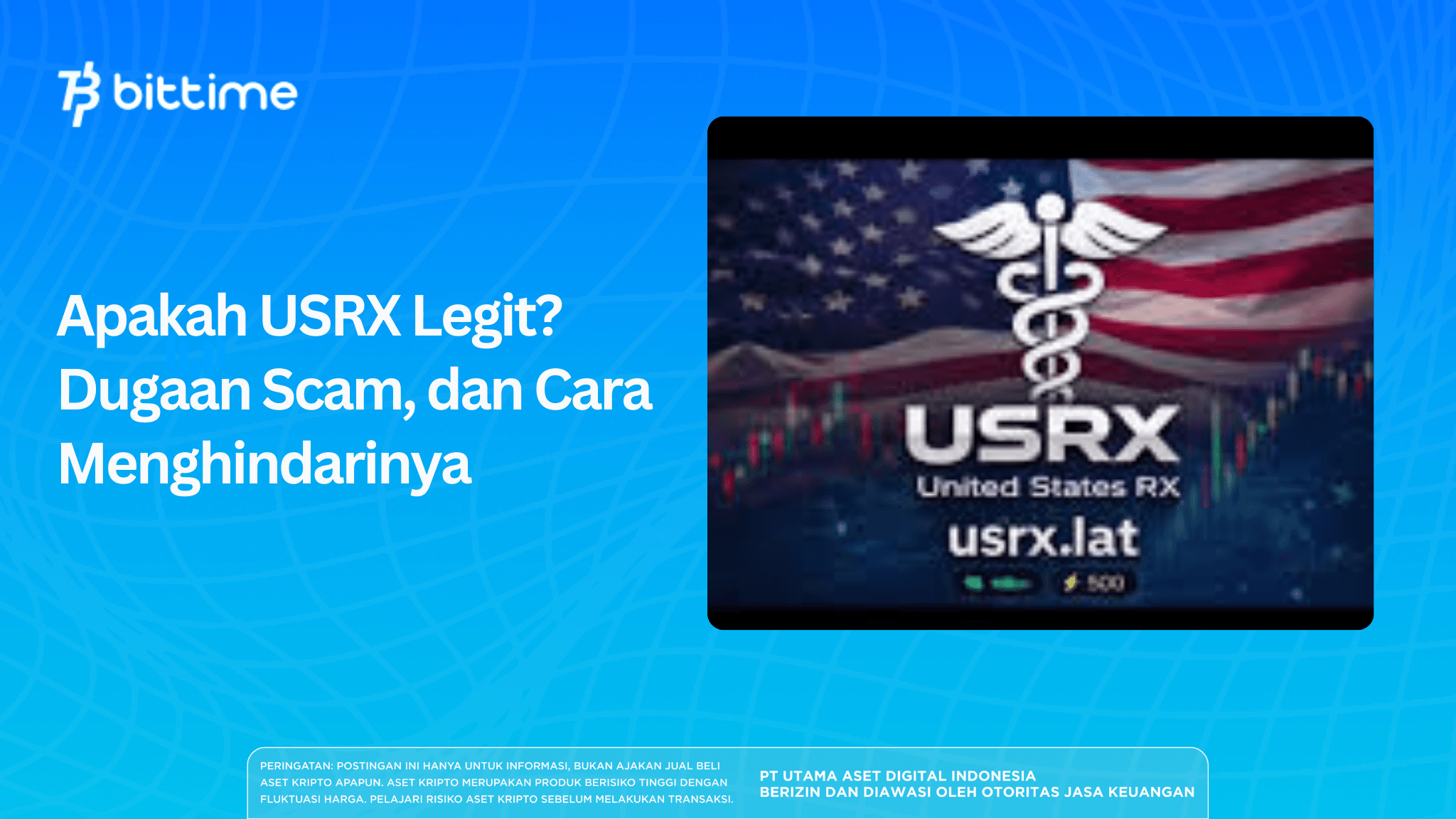

Is USRX Legit? Alleged Scam, and How to Avoid It

2026-02-16

The emergence of new memecoins always attracts attention in the crypto community, especially when they carry a sensational narrative. One that has recently become widely discussed is USRX, a token that claims to be linked to the United States' healthcare program and popular political figures like Donald Trump.

However, behind the narrative, many observers consider this project more like an opportunistic marketing strategy than a real innovation in the digital health sector.

Within weeks of its launch around February 2026, USRX was aggressively promoted through influencers on Instagram and TikTok.

The narratives constructed tend to be political and emotional, exploiting public health issues and perceptions of government legitimacy.

This kind of strategy isn't new in the crypto world, but it remains effective in attracting retail investors who haven't done in-depth research.

Key Points

- USRX has no official ties to US government health programs despite the narrative pointing that way.

- The project structure is not transparent and is not supported by credible independent audits.

- The promotional pattern resembles the rug pull scheme that occurred with previous memecoins.

Status Legitimacy USRX

This phenomenon shows howpolitical branding and public issuescan be used as a crypto marketing tool. In an investment context, this approach is a sign of caution, not attraction.

In terms of project credibility, USRX faces many fundamental questions. There's no comprehensive technical whitepaper, the development roadmap is unclear, and the identity of the development team isn't publicly verified. In the modern crypto ecosystem, these three factors constitute the minimum standard for transparency.

Read Also:AI-Based Crypto Scams on the Rise: Crypto Deepfakes

USRX Scam Allegations

A number of independent analysts have said that USRX has similarities with troubled projects.previously like the US Oil Reserveand USCR. The pattern appears relatively consistent: massive promotion through influencers, claims of high utility without technical evidence, and then a highly centralized token distribution among a few wallets.

Reports from crypto education platforms like 99Bitcoins and the crypto derivatives exchange BTCC state that the project exhibits fraudulent characteristics common to pump and dump schemes. This assessment is based on an analysis of holder distribution, liquidity activity, and the absence of verifiable institutional partnerships.

Public comments on various crypto forums are also filled with warnings from experienced users. Many highlight the high concentration of token ownership in certain wallets, which could potentially trigger sudden massive selling.

Read Also:List of 5 Crypto Assets US Crypto Reserve is Being Touted

Investment Risks to Watch Out For

Investing in memecoins has always been highly volatile, but USRX has displayed a number ofmore serious danger signscompared to ordinary speculative projects.

First, claims of ties to governments or political figures without official proof are a classic red flag in the crypto world. Legitimate projects typically display legal documents, official partnerships, or at least public statements from relevant parties.

Second, the lack of transparency in tokenomics prevents investors from assessing the token's inflation potential, supply distribution, or price stability mechanisms. Without such data, investment decisions become pure speculation.

Third, the dominance of large holders opens up opportunities for price manipulation. In a rug pull scenario, developers or early investors can sell tokens en masse after the price rises due to marketing hype.

Read Also:The US Crypto Reserve Is a Key to Stability or a Threat

Liquidity Limits

Furthermore, the lack of a listing on a major exchange also limits liquidity. Tokens with low liquidity are highly susceptible to extreme price fluctuations and difficult to sell when market sentiment changes.

For crypto investors looking to build a sustainable portfolio, the best approach is to prioritize projects with clear utility, organic communities, and open security audits.

Register at Bittime

Before you make your next crypto investment decision, considerregister on the trading platformTrusted exchanges like Bittime provide access to digital assets that have undergone a rigorous selection process and improved market education.

Conclusion

USRX is an example of how political narratives and public issues can be exploited in memecoin marketing. Although promoted as a token related to US healthcare, there is no concrete evidence to support this claim.

The lack of transparency, aggressive promotional patterns, and indications of centralized token distribution make this project high-risk for investors.

In the ever-evolving crypto world, literacy and caution are key safeguards. Investors are advised to avoid projects with large, unverified claims and to always conduct independent research before purchasing digital assets.

FAQ

What is USRX?

USRX is a Solana blockchain-based memecoin that claims to be linked to a US healthcare program, but has no official ties to any government agency.

Why is USRX considered risky?

Due to a lack of transparency, no credible audits, centralized token distribution, and promotional patterns that resemble pump and dump schemes.

Is USRX a legitimate crypto project in the healthcare sector?

No. There is no verifiable evidence of partnerships with healthcare or government institutions.

How to avoid crypto scam investments?

Check the whitepaper, security audits, token distribution, team reputation, and independent analysis sources before investing.

What are safer alternatives for novice investors?

Focus on crypto assets with clear utility, high liquidity, an active community, and availability on trusted trading platforms.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.