What Is Kadena and Why Is Kadena Called a Rugpull?

2025-10-23

Kadena, one of the blockchain projects once considered promising for introducing hybrid proof-of-work (PoW) technology and efficient smart contracts, has recently become the center of attention due to shocking news.

The KDA token price plunged more than 70% in just a few days after the development team announced the closure of its operations. Many in the crypto community are now asking: what exactly happened to Kadena, and is this a “rugpull” case?

What Is Kadena and How Does This Project Work?

Kadena is a blockchain network developed to combine the security of PoW systems like Bitcoin with the efficiency of smart contracts like Ethereum. Launched in 2019, the project aimed to build an ecosystem capable of handling thousands of transactions per second without compromising decentralization.

Kadena was designed using a multi-chain architecture, allowing multiple chains to work in parallel, thus improving scalability. Its main programming language, Pact, is claimed to be safer and easier for developers to understand compared to Ethereum’s Solidity. Over the years, Kadena managed to attract investor attention thanks to its efficiency promises and partnerships with several blockchain industry players.

However, technical excellence alone doesn’t always guarantee a project’s survival. Over time, interest in Kadena faded, transaction volumes shrank, and its developer ecosystem slowed. As the crypto market weakened throughout 2025, financial pressure and low community support became increasingly apparent.

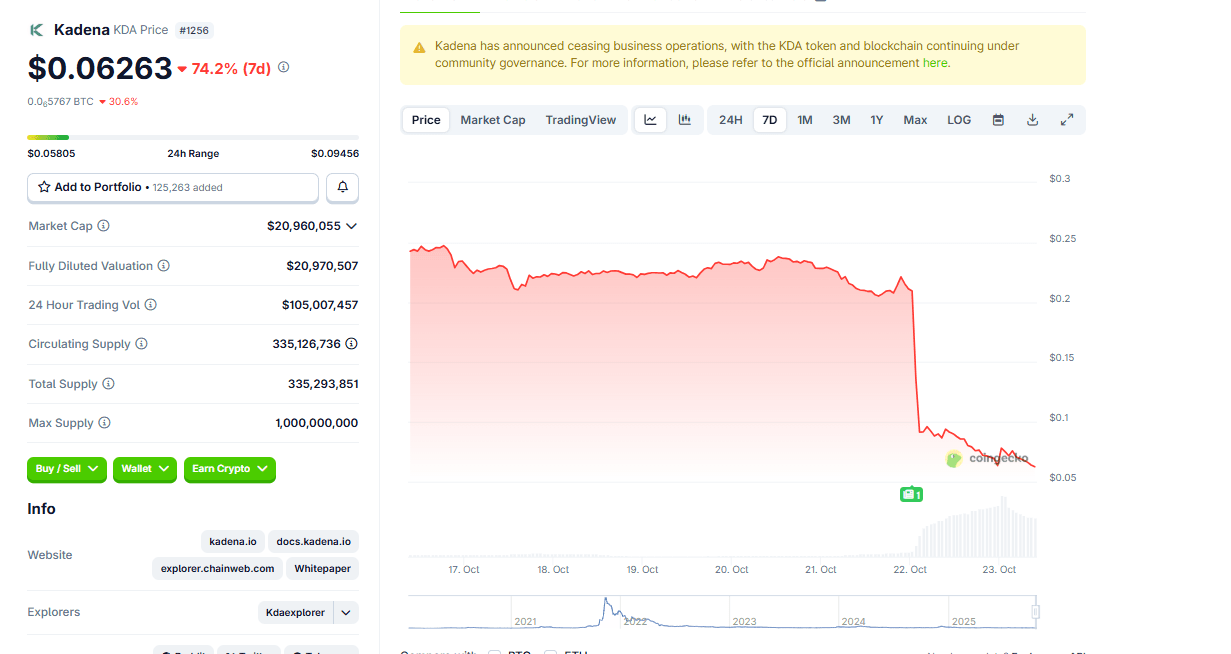

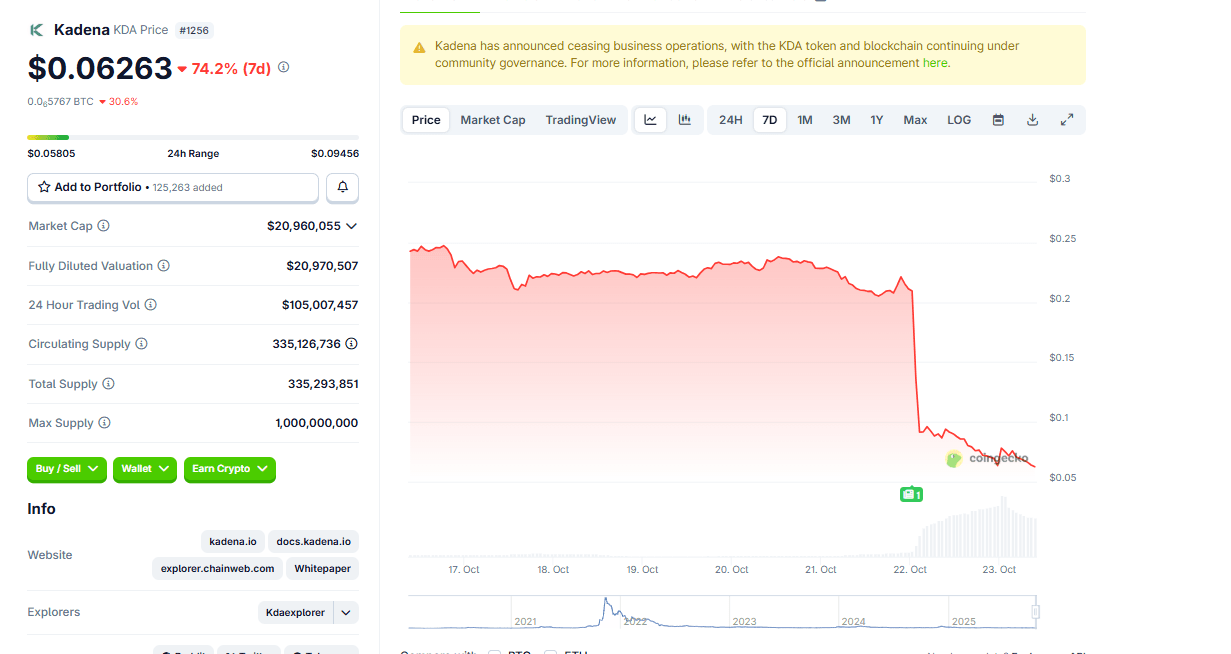

Kadena Price Chart Drops 74% in a Week

The Kadena price chart on CoinGecko shows a sharp drop of more than 74% in seven days, with KDA’s price briefly falling to around $0.06 on October 23, 2025. Its market cap also plummeted to about $20 million, while daily trading volume surged due to massive sell-offs.

The chart includes an official notice that Kadena has ceased all business operations, although its blockchain and KDA token will continue under community governance. This data highlights how the announcement deeply affected investor confidence and overall crypto market sentiment.

Kadena, one of the blockchain projects once considered promising for introducing hybrid proof-of-work (PoW) technology and efficient smart contracts, has recently become the center of attention due to shocking news.

The KDA token price plunged more than 70% in just a few days after the development team announced the closure of its operations. Many in the crypto community are now asking: what exactly happened to Kadena, and is this a “rugpull” case?

What Is Kadena and How Does This Project Work?

Kadena is a blockchain network developed to combine the security of PoW systems like Bitcoin with the efficiency of smart contracts like Ethereum. Launched in 2019, the project aimed to build an ecosystem capable of handling thousands of transactions per second without compromising decentralization.

Kadena was designed using a multi-chain architecture, allowing multiple chains to work in parallel, thus improving scalability. Its main programming language, Pact, is claimed to be safer and easier for developers to understand compared to Ethereum’s Solidity. Over the years, Kadena managed to attract investor attention thanks to its efficiency promises and partnerships with several blockchain industry players.

However, technical excellence alone doesn’t always guarantee a project’s survival. Over time, interest in Kadena faded, transaction volumes shrank, and its developer ecosystem slowed. As the crypto market weakened throughout 2025, financial pressure and low community support became increasingly apparent.

Kadena Price Chart Drops 74% in a Week

The Kadena price chart on CoinGecko shows a sharp drop of more than 74% in seven days, with KDA’s price briefly falling to around $0.06 on October 23, 2025. Its market cap also plummeted to about $20 million, while daily trading volume surged due to massive sell-offs.

The chart includes an official notice that Kadena has ceased all business operations, although its blockchain and KDA token will continue under community governance. This data highlights how the announcement deeply affected investor confidence and overall crypto market sentiment.

Kadena, one of the blockchain projects once considered promising for introducing hybrid proof-of-work (PoW) technology and efficient smart contracts, has recently become the center of attention due to shocking news.

The KDA token price plunged more than 70% in just a few days after the development team announced the closure of its operations. Many in the crypto community are now asking: what exactly happened to Kadena, and is this a “rugpull” case?

What Is Kadena and How Does This Project Work?

Kadena is a blockchain network developed to combine the security of PoW systems like Bitcoin with the efficiency of smart contracts like Ethereum. Launched in 2019, the project aimed to build an ecosystem capable of handling thousands of transactions per second without compromising decentralization.

Kadena was designed using a multi-chain architecture, allowing multiple chains to work in parallel, thus improving scalability. Its main programming language, Pact, is claimed to be safer and easier for developers to understand compared to Ethereum’s Solidity. Over the years, Kadena managed to attract investor attention thanks to its efficiency promises and partnerships with several blockchain industry players.

However, technical excellence alone doesn’t always guarantee a project’s survival. Over time, interest in Kadena faded, transaction volumes shrank, and its developer ecosystem slowed. As the crypto market weakened throughout 2025, financial pressure and low community support became increasingly apparent.

Kadena Price Chart Drops 74% in a Week

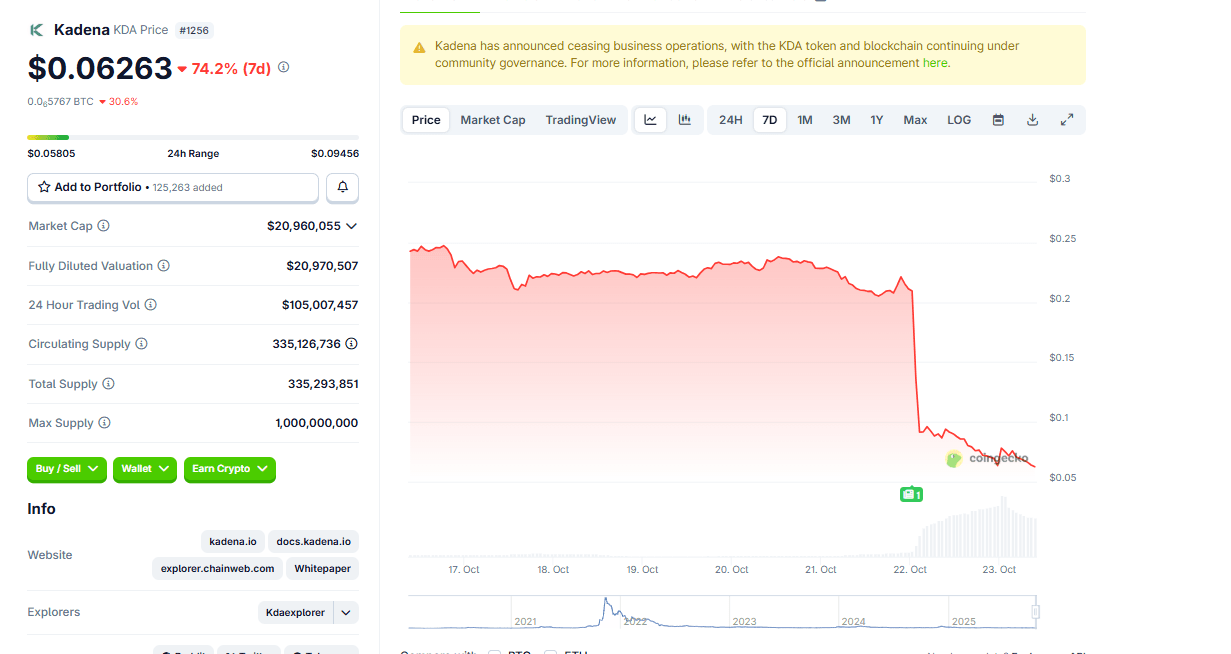

The Kadena price chart on CoinGecko shows a sharp drop of more than 74% in seven days, with KDA’s price briefly falling to around $0.06 on October 23, 2025. Its market cap also plummeted to about $20 million, while daily trading volume surged due to massive sell-offs.

The chart includes an official notice that Kadena has ceased all business operations, although its blockchain and KDA token will continue under community governance. This data highlights how the announcement deeply affected investor confidence and overall crypto market sentiment.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.