What is Lorenzo Protocol (BANK) and Its Price Prediction After a 40% Surge

2025-10-09

Bittime - Lorenzo Protocol (BANK) has been the center of attention in the crypto market after its price jumped more than 40% in the last 24 hours, outperforming the broader crypto market which rose about 0.57%.

This surge did not come out of nowhere — the project announced a series of strategic partnerships, new product launches, and a large airdrop distribution that fueled speculative activity.

In this article we explain what Lorenzo Protocol is, the key drivers behind the BANK price rise, and price predictions for Lorenzo Protocol in 2025 based on market conditions, partnerships, and technical indicators.

What is Lorenzo Protocol (BANK)?

Lorenzo Protocol is a DeFi platform focused on a USD1 stablecoin and yield products (USD1+) backed by real-world assets (RWA).

The project's main token, BANK, functions as a governance token that allows holders to make decisions within the Lorenzo ecosystem — including yield policy, incentive distribution, and reserve allocation.

Lorenzo aims to bridge traditional finance and blockchain through B2B stablecoin settlements and on-chain interest-bearing investment products.

Read also: Lorenzo Protocol Price Today | BANK/IDR

Strategic Partnership with BlockStreet (Bullish)

On August 12, 2025, Lorenzo Protocol announced a major partnership with BlockStreetXYZ, a provider of decentralized financial infrastructure for corporations.

The partnership's primary goal is to expand the use of the USD1 stablecoin for cross-border B2B settlements.

This partnership strengthens Lorenzo’s position as a key player in enterprise DeFi. BANK, as the governance token, could become part of a transaction infrastructure used by companies for international settlements.

Investors should watch whether large companies begin using USD1 through the BlockStreet network — real adoption would be a powerful long-term catalyst for BANK.

BANK Airdrop Momentum

Lorenzo Protocol also drew attention with a large BANK airdrop, with the claim window running from August 3 to September 3, 2025.

A total of 42 million BANK tokens were distributed to the community — equivalent to 8% of total supply.

Market implications:

- The airdrop triggered a surge in volume and speculative buying as many users attempted to qualify for distribution.

- Historically, airdrops are often followed by profit-taking.

- Selling pressure can increase after the claim window closes.

After September 3, approximately $5.6 million worth of BANK could enter the market, potentially weighing on short-term price action.

Read also: What are Real World Assets (RWA)? Check RWA Tokens on Bittime

Technical Indicators & Short-Term Correction Risk (Bearish)

Technically, BANK shows an overbought condition.

- RSI (Relative Strength Index): 87 — well above the 70 overbought threshold.

- Current Price: $0.135, up 62% from the 30-day average ($0.083).

- Fibonacci support: $0.115 — a key area to test buyer strength.

Although the short-term trend is bullish, technical signals warn of a possible price correction.

If trading volume falls below $90 million, selling pressure could push BANK back into the range of $0.115–$0.12.

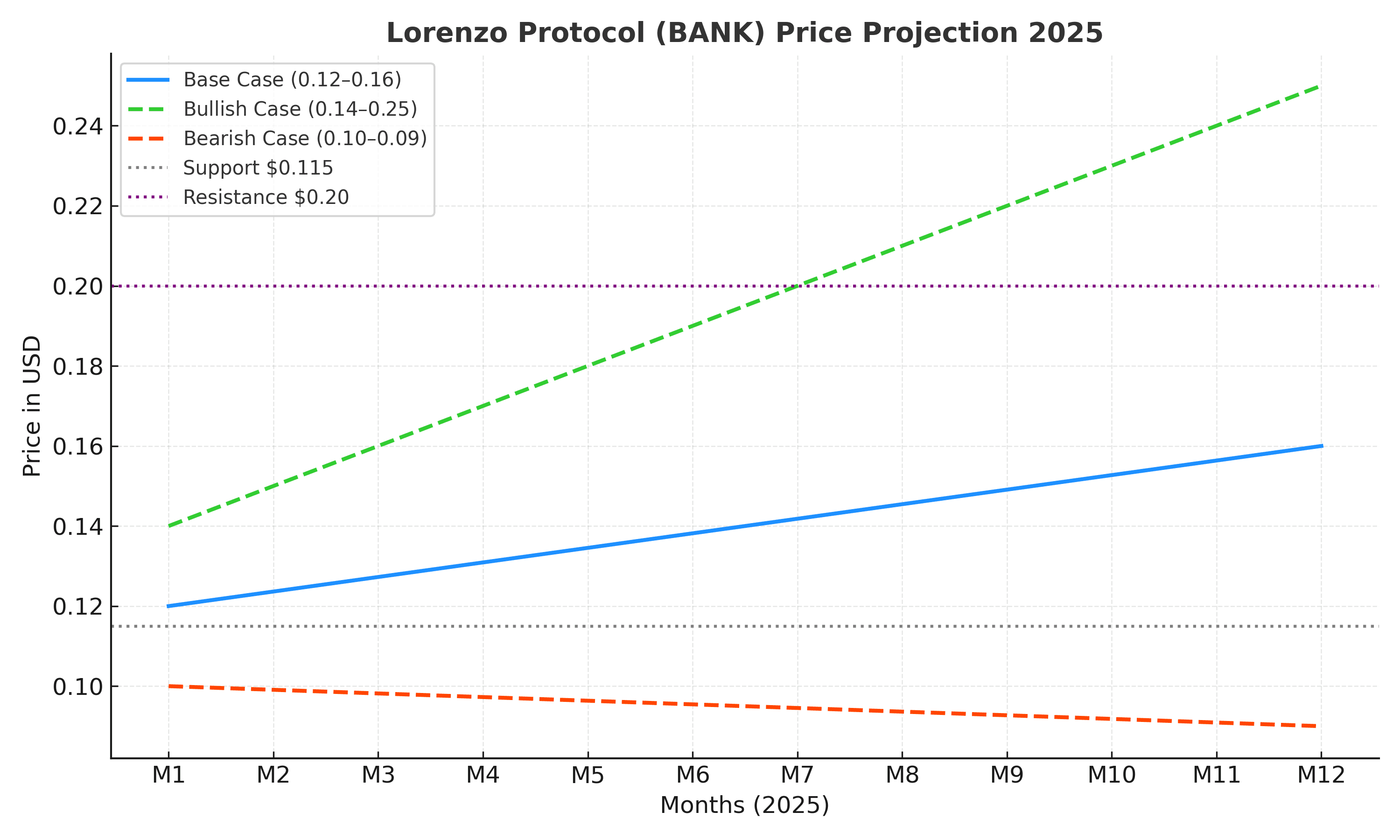

Outlook & Price Predictions for Lorenzo Protocol (BANK) — 2025

Optimistic Scenario (Bullish)

If the BlockStreet partnership and B2B integrations with partners like TaggerAI succeed, and TVL (Total Value Locked) grows steadily, BANK could break into the $0.20–$0.25 range by the end of 2025.

Rising demand for USD1+ yield products in DeFi would support such a rally.

Moderate Scenario (Base Case)

BANK is expected to trade between $0.12–$0.16 through Q4 2025, with high volatility after the airdrop. Medium-term investors may use this consolidation window to accumulate.

Pessimistic Scenario (Bearish)

If selling pressure after the airdrop is not contained, or if the project fails to attract new corporate clients, BANK could fall to around $0.09–$0.10, approaching the initial TGE support levels.

External notes:

- CoinMarketCap shows a 350% increase in 7-day volume, indicating strong speculative interest in recent days.

- BANK could be projected as a “Top 10 AI-Integrated DeFi Token” if USD1+ sustained yields remain above 10% APR.

Read also: Mantle (MNT) Price Prediction — October 2025

Conclusion

Lorenzo Protocol’s 40% price surge reflects a near-perfect mix of airdrop momentum, a major partnership, and a strong stablecoin narrative.

However, technical indicators warn of a possible short-term correction due to overbought conditions and selling pressure from newly distributed tokens.

Long-term prospects for BANK remain positive if Lorenzo continues to grow the USD1+ ecosystem and broaden partnerships with major companies — but investors should stay alert to post-airdrop volatility.

How to Buy Crypto on Bittime

Want to trade or buy Bitcoin and invest in crypto easily? Bittime can help. As an Indonesian exchange registered with Bappebti, Bittime ensures transactions are safe and fast. Start by registering and verifying your identity, then deposit a minimum of Rp10,000 and you can buy digital assets right away.

Check exchange rates like BTC to IDR, ETH to IDR, and SOL to IDR on Bittime to follow market trends in real time.

Also visit the Bittime Blog for reliable updates and educational content about Web3, blockchain technology, and investing tips to deepen your crypto knowledge.

FAQ

What is Lorenzo Protocol (BANK)?

Lorenzo Protocol is a DeFi project focusing on a USD1 stablecoin and USD1+ yield products. The BANK token serves as governance and the primary utility token of the ecosystem.

Why did BANK surge sharply?

The 40% increase was driven by a strategic partnership with BlockStreetXYZ, a large community airdrop, and high speculative interest in the token’s utility.

When does the BANK airdrop claim period end?

The airdrop claim window runs until September 3, 2025. After that date, distributed tokens may add selling pressure to the market.

What is the price prediction for Lorenzo Protocol in 2025?

In the optimistic scenario BANK could reach $0.20–$0.25. Moderate projections place it around $0.13–$0.16 for 2025.

Is Lorenzo Protocol safe for long-term investment?

If the project continues to expand USD1 integrations and attract institutional partners, long-term potential looks promising. Still, investors must be cautious about post-airdrop volatility.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.